Bula Vinaka & Welcome

A Guide to Fiji’s Capital Markets

This webpage aims to expand your understanding of Fiji’s Capital Markets, whether you are an ordinary investor seeking opportunities to grow your savings or a business looking to raise capital. It complements the work undertaken by the Capital Markets Advisory and Development Taskforce, which was formed to assist Reserve Bank in the promoting and developing Fiji’s Capital Markets.

Overview

Capital markets are organised venues where the wealth of savers are channelled into long-term, productive use by entities such as businesses, government and other institutions looking to raise funds. Developed and efficient capital markets assist in the creation and expansion of businesses by directing surplus finance, from savers to businesses that require funds for development and growth. This in turn creates employment leading to economic growth and fosters technological innovation.

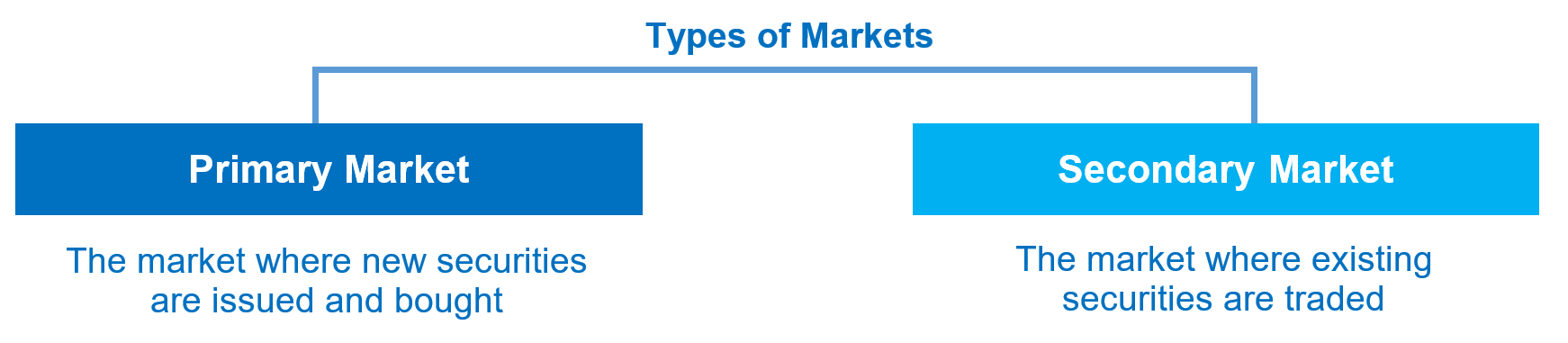

In order to raise or borrow funds through the capital markets, a variety of financial assets or instruments – often referred to as securities – are issued by entities in the primary market. In return, savers who use their wealth to buy securities are entitled to income or returns from their investments. These securities can be traded between investors in what is known as the secondary market.

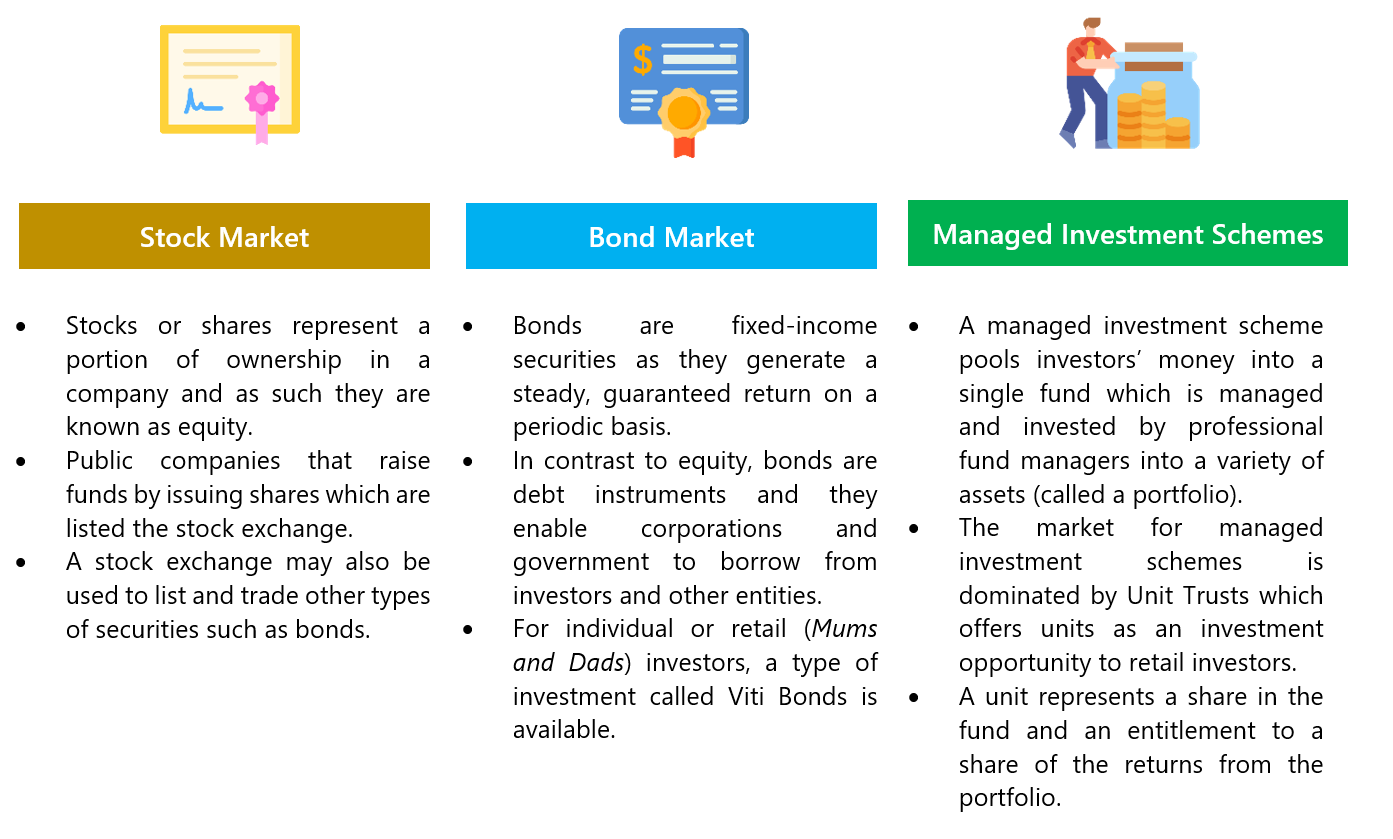

There are also markets for specific types of securities or investments. Fiji’s capital markets features a stock market, a bond market and a managed investment scheme market.

What you will find on this page

What you will find on this page

1. Investment Offers

Our investment offers page provides insight into these major markets and licensed institutions. Members of the public who wish to participate and invest in the capital markets must ensure that they deal only with licensed entities and professionals and understand the risks associated with each type of investment.

2. Regulatory Framework

The RBF licenses all entities that raise funds and provide financial services in the capital markets. An overview of key legislation, regulations and policies is provided in our regulatory framework page.

3. Capital Markets Development

This page provides information on development initiatives of the Reserve Bank in conjunction with the Capital Markets Development and Advisory Taskforce. You will also find media notes of the Taskforce’s quarterly meetings.

4. Resources

A number of useful publications and key resources can be found here, including a Frequently Asked Questions (FAQs).

Should you require further information or clarification on any of the content provided on these pages, please do not hesitate to contact us.